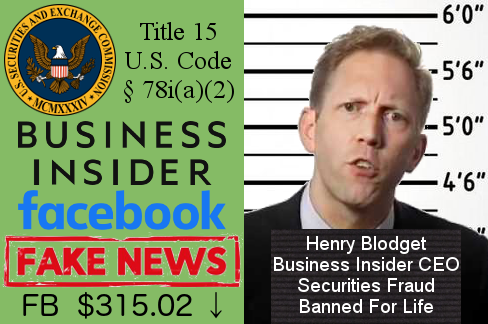

Banned-For-Life Trader and Business Insider CEO Henry Blodget Using Fake News for Stock Price Manipulation?

By Duane Thresher, Ph.D. May 5, 2021

After I wrote IT Reporting: Scraping the Bottom of the Barrel with a Fake Facebook Data Breach, I wondered why a major media news outlet like Business Insider would publish fake news about Facebook and risk a multi-million dollar libel lawsuit that Facebook could easily win. Having written Stock Market Crash Deja Vu: Reddit Violates Securities Exchange Act earlier this year, the answer came to mind: Business Insider planned to make at least that much by short selling Facebook stock and driving its price down with the fake news. I then proceeded to mail a complaint of this illegal (Title 15 of U.S. Code, § 78i(a)(2)) stock price manipulation to the Securities and Exchange Commission (SEC), with copies mailed to Facebook and Business Insider. This SEC complaint is particularly important because it has a bearing on the federal government's current ridiculously-weak anti-monopoly case against Facebook: Federal Trade Commission v. Facebook Inc., U.S. District Court for the District of Columbia, Case No. 1:20-cv-03590. After mailing this SEC complaint, I was investigating who else at Business Insider should have their records, particularly emails, subpoenaed to look for evidence of the crime. I discovered that the founder, editor-in-chief, and CEO of Business Insider, Henry Blodget, had been convicted by the SEC of essentially the same securities fraud of stock price manipulation by fake news, been fined $4 million, and been banned for life from the securities industry. Thumbing his nose at and taunting the SEC, Blodget then founded Business Insider, which is the perfect cover for continuing this illegal stock price manipulation.

During the media-created "Facebook-Cambridge Analytica data scandal" (2018) described in IT Reporting: Scraping the Bottom of the Barrel with a Fake Facebook Data Breach, Facebook's stock price plummeted. It occurred to me, before discovering Henry Blodget, that this may have given an idea to many criminally-minded people, such as in the media, particularly the business media. This idea — to short sell a stock and then drive its price down using fake news — would have seemed an even better idea to these people with the successful GameStop stock shorting incident by Reddit earlier this year; see Stock Market Crash Deja Vu: Reddit Violates Securities Exchange Act.

This market manipulation is illegal. On the SEC's complaint webpage, www.sec.gov/tcr, they've written

Manipulation of a security’s price or volume →This is just a simplification of Title 15 of U.S. Code, § 78i(a)(2), which is given in my SEC complaint and in Stock Market Crash Deja Vu: Reddit Violates Securities Exchange Act.

Market manipulation is when someone artificially affects the supply or demand for a security (for example, causing stock prices to rise or to fall dramatically).

Market manipulation may involve techniques including:Spreading false or misleading information about a company;

In my SEC complaint I demanded that the SEC investigate and prosecute this crime by Business Insider. Since it was before discovering Henry Blodget, I suggested to the SEC that they start with the fake Facebook data breach news author

Business Insider Tech Reporter Aaron Holmes <aholmes@businessinsider.com>but that he could not have gotten the article published by himself. He would have needed permission, or he was instructed to do so, by one or more of

Business Insider Global Editor-in-Chief Nicholas CarlsonI reminded the SEC that I would and could force them to investigate:<nicholas@businessinsider.com>

Business Insider Global Managing Editor Jessica Liebman<jliebman@insider.com>

Business Insider Deputy Editor-in-Chief Emily Cohn<ecohn@insider.com>

Business Insider Executive Managing Editor Lyndsay Hemphill<lhemphill@businessinsider.com>

Business Insider Executive Managing Editor Leah Goldman<lgoldman@businessinsider.com>

Business Insider Managing Editor Fritzie Andrade<fandrade@insider.com>

Dr. Duane Thresher v. Governor of Virginia Ralph Northam, U.S. District Court, Eastern District of Virginia, Richmond Division, Judge David Novak, Case No. 3:20-cv-307.I do even more for my Apscitu Inc. clients.

Finally, in my SEC complaint, I pointed out that this case had a bearing on the federal government's current ridiculously-weak anti-monopoly case against Facebook:

Federal Trade Commission v. Facebook Inc., U.S. District Court for the District of Columbia, Case No. 1:20-cv-03590.By letting Business Insider get away with publishing its fake news about Facebook as part of Business Insider's illegal stock shorting scheme, the federal government hurts Facebook's stock price and weakens the company, making it easier for the federal government to make Facebook do what it wants (and see Fake Federal Facebook Fury Finally Finished).

(Note that the Federal Trade Commission uses Microsoft email so was hacked during The Doomsday Microsoft Government Email Data Breach and/or Doomsday II: The Massive Microsoft Email Data Breach Sequel. Moreover, so was the entire federal judicial system; see Hackers Own The Federal Legal System and Federal Judiciary Reacts To Hackers: Evidence Tampering OK, Exposing NSA Surveillance Not.)

Reddit got away with this same crime earlier this year because the lazy incompetent media-collaborating SEC refused to investigate and prosecute — even after I demanded they do so (see Update at end of Stock Market Crash Deja Vu: Reddit Violates Securities Exchange Act) — but as of just last month the SEC has a new Chairman, Gary Gensler

, who was appointed by President

Joe Biden

, who was appointed by President

Joe Biden

and who I will have more to say about later.

and who I will have more to say about later.A real investigation of this crime would include subpoenas of the personal financial records of all the listed Business Insider personnel, to look for financial gain after the fake news. However, they could have committed the crime and not made any money; it's still a crime. Thus, subpoenas of all their emails would be required, to look for the arranging of the crime. This would also show whether there was a conspiracy to commit the crime.

After my SEC complaint, I was investigating who else at Business Insider should have their records subpoenaed to look for evidence of the crime. I discovered the founder, editor-in-chief, and CEO of Business Insider, Henry Blodget

Business Insider CEO & Founder Henry Blodgetwho became the prime suspect, particularly as leader of a conspiracy.<hblodget@insider.com>

Henry Blodget joined the securities industry in the mid-1990's. In 1998 he publicly guessed that Amazon's stock price would rise significantly, and when it did he became a media darling, the great tech stock picker. After that he accepted an offer to work at Merrill Lynch. While there, in 2000, just days before the dot-com bubble burst, he invested $700,000 in tech stocks, which he lost after the bubble burst, leaving him in financial straits. (Note that in 2014, Amazon CEO Jeff Bezos invested in Business Insider.)

In 2002, it was discovered by then New York Attorney General Eliot Spitzer ("The Sheriff of Wall Street") — from Henry Blodget's emails — that while at Merrill Lynch, Blodget committed securities fraud; essentially the same one he is accused of here, stock price manipulation by fake news. In 2003, Blodget was charged by the SEC, fined $4 million, and banned for life from the securities industry.

Henry Blodget then founded Business Insider, which is the perfect cover for illegal stock price manipulation by fake news. I suspect that the name "Business Insider", which begs comparison to the crime of "insider trading", is Blodget thumbing his nose at the SEC and a taunting announcement of his intentions.

On Henry Blodget's Business Insider author page he does not mention being banned for life by the SEC for illegal stock price manipulation by fake news, nor that being a terrible tech stock picker is what got him in financial then legal trouble in the first place. He only states, at the bottom,

"During the dot-com boom of the late 1990s, Henry was a top-ranked Wall Street internet analyst. He was later keelhauled by then-Attorney General Eliot Spitzer over conflicts of interest between the research and banking divisions of brokerage firms."It's been long enough now for Henry Blodget to have been forgotten, and off everyone's radar, particularly the SEC's, always very weak anyway. He's probably desperate to make a financial killing to retire on. The "Facebook-Cambridge Analytica data scandal" and the successful GameStop stock shorting incident by Reddit probably inspired and emboldened Blodget.

I'll also be mailing this discovery of banned-for-life trader and Business Insider CEO Henry Blodget, including this article, to the SEC, with copies to Facebook and Business Insider. We'll see what kind of SEC Chairman Gary Gensler

is going to be: The Sheriff of Wall

Street or

Sergeant "I see nothing" Schultz

is going to be: The Sheriff of Wall

Street or

Sergeant "I see nothing" Schultz

from Hogan's

Heroes.

from Hogan's

Heroes.