Cryptocurrency Crisis: All Cryptocurrencies Might As Well Be Tulip Bulbs

By Duane Thresher, Ph.D. November 17, 2022

Cryptocurrency is IT; information technology, in case you forgot. Cryptography, from whence cryptocurrency gets its name, is the technology of encrypting/decrypting information; see Incompetent Encryption Is Worse Than No Encryption.

The name "cryptocurrency" is not because transactions with it are secret, which is decidedly not the case (see ahead). And while who is involved in the transactions can be hard to find, particularly if one transactor is in another country, like Russia (see ahead), if one of the transactors wants to exchange the cryptocurrency for real money (dollars) in the U.S., it is not that hard to find them; see for example the Update at the end of Apscitu Warned of Twitter Hacking Two Years Ago, where the hackers got payment in Bitcoin and were then easily identified and caught.

A cryptocurrency, like Bitcoin, the original cryptocurrency, uses a publicly-readable digital ledger, a "blockchain" — literally a chronological chain of data blocks — to record all transactions. To make sure that this blockchain is not tampered with, cryptographic techniques are used on it, specifically hashing (see How Twitter Made a Hash of Passwords) on each block, with its hash included in the next block.

Further, owners of cryptocurrency have cryptographic keys that prove that they own the cryptocurrency; again see Incompetent Encryption Is Worse Than No Encryption. Owners are supposed to keep these keys secret, since whoever has these keys can do whatever they want with the cryptocurrency. Note though, that in a cryptocurrency exchange (see ahead), the exchange, not the owners, may have these keys.

That's all you really need to know about the "crypto" part of "cryptocurrency". Now the "currency" part.

Currently, there is a Cryptocurrency Crisis (I coined that name).

Samuel "Sam" Bankman-Fried, nicknamed "SBF", started in 2019 a Bahamas-based cryptocurrency exchange — like a Wall Street investment bank, such as the now defunct Lehman Brothers — called FTX, with himself as CEO. Their cryptocurrency were FTT tokens. SBF persuaded many investors, including institutional investors (pension funds, etc.), big venture capitalists, and celebrities, to invest billions of dollars in FTX, in exchange for these unbacked intrinsically-worthless made-up FTT tokens. SBF had also started a supposedly-separate FTT trading firm, Alameda Research, and appointed Caroline Ellison as CEO.

Alameda Research made wild bets in the market for FTT and lost billions of dollars, so much so that it had to secretly borrow billions of dollars from supposedly-separate FTX. Ultimately, FTT tokens became worthless even in the market and billions of dollars disappeared.

Because of this, all other cryptocurrencies, like Bitcoin, are becoming — rightfully so (see ahead) — much less trusted, so plunging in value (dollars). Hence, the Cryptocurrency Crisis.

So many billions of dollars have been lost, there is serious concern that this Cryptocurrency Crisis could be as bad as the Subprime Mortgage Crisis, which in 2008 led to the Global Financial Crisis and literally almost destroyed the world economy, after destroying the heavily-involved Lehman Brothers. See The Big Short: Inside the Doomsday Machine by Michael Lewis, who is going to do a book on Sam Bankman-Fried, after hanging around him for the last six months. Like the Cryptocurrency Crisis, during the Subprime Mortgage Crisis investors also invested in made-up (derivatives) things, mortgage-backed securities, of little real value.

The Cryptocurrency Crisis was inevitable.

The only thing that makes any currency of any real value is government backing. In the U.S., the Federal Reserve controls the value of the dollar via its control of the supply of dollars, which in turn is via its control of the interest rate charged to banks for getting these dollars. This "federal funds rate" is often in the news, particularly currently, since it affects markets so much. Increasing the dollar supply, via decreasing the federal funds rate, decreases the value of the dollar, which increases inflation; and vice versa.

Currently, with inflation so high, the Federal Reserve is successively increasing the federal funds rate, thus decreasing the dollar supply, increasing the value of the dollar, and decreasing inflation. This is ironic because the Federal Reserve was partially responsible for the high inflation in the first place; see The Lords of Easy Money: How the Federal Reserve Broke the American Economy by Christopher Leonard.

Cryptocurrency pushers claim the lack of government backing is its biggest advantage — even though it clearly has not been — since backing brings with it more regulation. Currently, cryptocurrency is only regulated as an investment, by the Securities and Exchange Commission (SEC), led by Chairman Gary Gensler. However, the SEC and Gensler in particular have done little to regulate cryptocurrency, while even promoting it.

Cryptocurrency is just another in a long line of investment speculation bubbles since the 1600's, when the Dutch pioneered modern investment markets. In these speculation bubbles, the prices of things of little real value skyrocket, until everyone comes to their senses and the bubble bursts, costing most investors a lot of money. One of the first speculative bubbles was the Dutch Tulip Mania in 1637, as described in Extraordinary Popular Delusions and the Madness of Crowds by Charles Mackay. Prices for single tulip bulbs grew to become greater than the price of a big house. Nine years ago, in 2013, Nout Wellink, former president of the Dutch Central Bank, called Bitcoin "pure speculation" that was worse than Tulip Mania because at least with that you got a tulip bulb when the bubble burst; with Bitcoin you will get nothing.

A huge undiscussed problem with cryptocurrency is that it siphons off billions of dollars, particularly from venture capitalists, from ventures that could rebuild American infrastructure; see Wanted: Visionary Investors for Historic Business Plan. Wall Street grew out of the need to get capital to build American infrastructure. Non-capitalist countries don't get better, they decay until they collapse, like communist East Germany.

With its only real value being tricking people out of real money, cryptocurrency has become the new currency of criminals — which at this point would include Sam Bankman-Fried and Caroline Ellison — now that electronic payment has become so ubiquitous. (Again, as stated, who is involved in a cryptocurrency transaction can be hard to find, and prosecute, particularly if one transactor is in another country, like Russia.) For example, ransomware and other hacking is paid off in Bitcoin; see U.S. Surrenders in IT War, Starts Paying Tribute to Russia and Apscitu Warned of Twitter Hacking Two Years Ago. Further, Bitcoin is used for the sale of illegal goods (e.g. drugs) on the Internet; for example, the Silk Road online black market.

The U.S. Government has been strongly encouraging electronic payment, at the expense of good old cash, so that it can keep more complete tabs on people, particularly criminals, while at the same time encouraging, particularly via SEC Chairman Gary Gensler, the use of cryptocurrency, but doing little to regulate it.

That's all for the "currency" part of "cryptocurrency". Now to the personalities, which is what the media concentrates on, even while not knowing much about them, at least not as much as I do, being from MIT.

As much as I hate to admit it, FTX CEO Sam Bankman-Fried

is from MIT. But he got a B.S. in

Physics — not "and Math" as has been widely misreported

in the media — which these days often makes the holder

unemployable. The old joke about physicists:

is from MIT. But he got a B.S. in

Physics — not "and Math" as has been widely misreported

in the media — which these days often makes the holder

unemployable. The old joke about physicists:

How does a physicist model a dairy farm? First, he assumes the cows are spheres and the farm is a vacuum.My MIT B.S. is in Electrical Engineering and Computer Science, whose holders are highly sought after and for which MIT is more famous these days than physics.

Alameda Research CEO Caroline Ellison

is not from MIT, but her father is.

Glenn Ellison is, ironically, a professor of economics at MIT

and wrote the textbook/workbook Hard Math for Middle

School specifically for Caroline, as it says in the

textbook introduction, when she was in middle school, not too

long ago. The book is actually quite popular (it's on

Amazon)

among homeschoolers. Unfortunately, it's also full of typos,

like it was never proofread, even though the introduction says

Caroline proofread it.

is not from MIT, but her father is.

Glenn Ellison is, ironically, a professor of economics at MIT

and wrote the textbook/workbook Hard Math for Middle

School specifically for Caroline, as it says in the

textbook introduction, when she was in middle school, not too

long ago. The book is actually quite popular (it's on

Amazon)

among homeschoolers. Unfortunately, it's also full of typos,

like it was never proofread, even though the introduction says

Caroline proofread it.Worse, Caroline Ellison got a bachelor's degree in math from Stanford University and has been widely quoted as saying about her job as Alameda Research CEO, "I could pull it off without my math degree. I use very little math. I use a lot of elementary school math."

(Alameda Research former co-CEO John "Sam" Trabucco

is also from MIT, with a bachelor's

degree in math, but is not mentioned much in the media.

Suspiciously, Trabucco withdrew from Alameda just a couple of

months before the bubble burst, when his overt net worth would

have gone from billions of dollars to nearly nothing, like

those of Sam Bankman-Fried and Caroline Ellison. Trabucco was

in Hong Kong, which is maybe where the missing billions of

dollars are. The Chinese government doesn't allow the use of

cryptocurrency inside China, but would happily profit from its

use in, and destruction of, other countries.)

is also from MIT, with a bachelor's

degree in math, but is not mentioned much in the media.

Suspiciously, Trabucco withdrew from Alameda just a couple of

months before the bubble burst, when his overt net worth would

have gone from billions of dollars to nearly nothing, like

those of Sam Bankman-Fried and Caroline Ellison. Trabucco was

in Hong Kong, which is maybe where the missing billions of

dollars are. The Chinese government doesn't allow the use of

cryptocurrency inside China, but would happily profit from its

use in, and destruction of, other countries.)Like Glenn Ellison, Gary Gensler

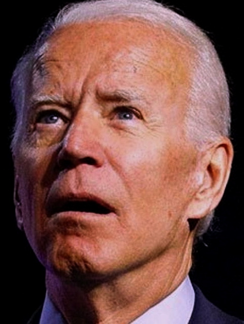

, SEC Chairman appointed by President

Joe Biden

, SEC Chairman appointed by President

Joe Biden

, is a professor of economics at MIT.

I took economics at MIT when I was an undergrad there and was

struck by the low level of math they used; concepts better

handled by calculus and differential equations were done with

high school math. Gensler got his bachelor's degree in

economics from the University of Pennsylvania, in Philadelphia

(which seems to have problems counting votes).

, is a professor of economics at MIT.

I took economics at MIT when I was an undergrad there and was

struck by the low level of math they used; concepts better

handled by calculus and differential equations were done with

high school math. Gensler got his bachelor's degree in

economics from the University of Pennsylvania, in Philadelphia

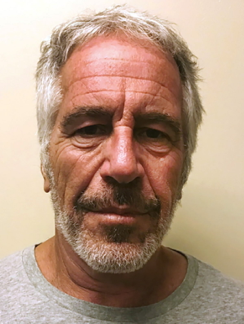

(which seems to have problems counting votes).As an academic, Gary Gensler focuses on blockchain technology and digital currencies, i.e. cryptocurrency, but with no IT degree is IT incompetent and can be no expert on these. He is senior adviser to the MIT Media Lab Digital Currency Initiative. The MIT Media Lab was at the center of a nationally-reported scandal when it accepted large donations, of real money, from convicted child sex offender and trafficker Jeffrey Epstein

. This scandal engulfed even the

President of MIT,

Rafael Reif

. This scandal engulfed even the

President of MIT,

Rafael Reif

, which I have written

about.

, which I have written

about.As indicated, SEC Chairman Gary Gensler has been a big (ignorant) promoter of cryptocurrency, while at the same time doing little to regulate it. He even met with FTX CEO Sam Bankman-Fried to discuss allowing FTX to do even more.

The U.S. House of Representatives, now controlled by the Republicans, will be investigating SEC Chairman Gary Gensler, particularly since FTX has been one of the largest donors to the Democrats over the last few years.

I warned about cryptocurrency accomplice SEC Chairman Gary Gensler 18 months ago; see U.S. Surrenders in IT War, Starts Paying Tribute to Russia and Banned-For-Life Trader and Business Insider CEO Henry Blodget Using Fake News for Stock Price Manipulation? To report the latter to the SEC, I even emailed Gensler directly, both at the SEC and MIT.

It might seem I should be embarrassed about being from MIT, but I am not; the opposite in fact. Besides the various departments being quite different, MIT in general really started to go to hell a few years after I graduated from there in the early 1990's, when political correctness then wokeism struck with a vengeance. I have done what I can to fight this, and been retaliated against by MIT for doing so; see for example MIT Lawyers v. Dr. Thresher.

And, unlike most of the personalities above, at least I'm smarter than a tulip bulb

.

.